The New Face of Indian Beauty

A few years ago, skincare wasn't much of a topic in India's Tier 2 and Tier 3 cities. Most of us only grew up seeing TV commercials for products like Fair & Lovely, where the idea of success, likability, and attractiveness was tied to having fair skin. Back then, we didn't question these concepts much or think about ideas like self-love or racism. It just felt normal.

Fast forward to today, and the beauty landscape has shifted dramatically. Consumers are now focused on finding the right foundation shades and practicing skincare as an integral part of self-care. When we look back, it's clear there has been a drastic change in the cosmetic industry and our perception of beauty.

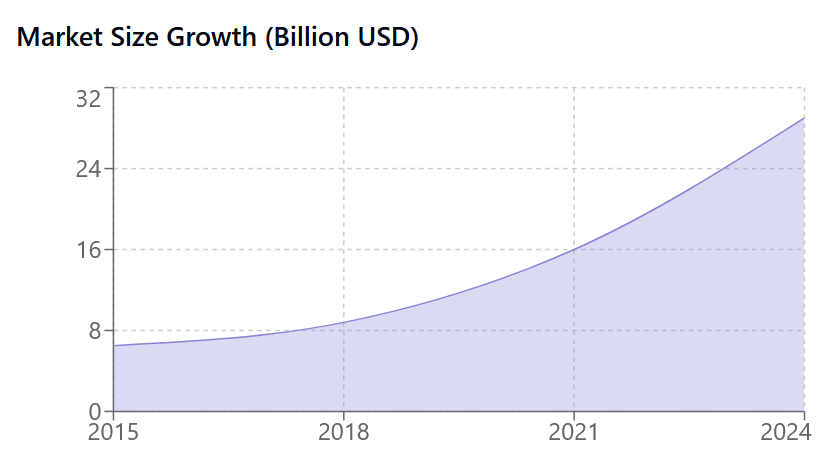

Rise of Cosmetic Unicorns: "Indian brands understand my skin better." Beauty industry giants like Nykaa, Purplle, Mamaearth, The Good Glamm Group, and MyGlamm have created large businesses around this idea. The Indian beauty and personal care market is set to grow to $33.33 billion by 2027, according to a report by Statista. This staggering growth underscores the shift from fairness-focused products to choosing the correct shade of foundation.

Here's an estimate of the Indian beauty and cosmetic market growth:

But what exactly triggered this change in just over a decade? Let's understand the causes:

Skincare wasn't much of a topic in India's Tier 2 and Tier 3 cities. If we closely look at the pattern. This gap has led to a new beauty and skincare market valued at billions of dollars.

The 'self-care' mindset in skincare The fact that skincare is now seen as self-care is so embedded in our culture that it propagates a set of new assumptions:

Skincare = Part of Self-Care.

- I need to understand my skin type and concerns

- If I take care of my skin - I'm practicing self-care

- "Use sunscreen daily to protect your skin."

- "Develop a skincare routine for healthy skin."

- "Choose products that suit your skin type for best results."

But how do people choose skincare products?

Urban India primarily looks for five signals in skincare products: ingredients, brand reputation, reviews, price, and effectiveness. But for Tier 2 and 3 cities or Bharat, choosing skincare products is more complex than you'd imagine. While they also might have some of these considerations, the primary decision making factors are not the same, influenced mainly by their context.

#1 Internet and Smartphone Accessibility: As Internet and mobile access has changed every industry sector it has bring some much value into cosmetic world too. The widespread availability of the internet and smartphones has opened the door to a wealth of information. People in even smaller towns can now educate themselves on skincare routines and the right products to use, leading to more informed decisions.

How does it influence skincare and makeup? Access to knowledge: The internet has democratized skincare knowledge, allowing consumers to learn about ingredients, routines, and product reviews.

Informed choices: Consumers can now research products before purchasing, leading to more conscious and personalized skincare decisions.

#2 E-commerce and Accessibility: "I can buy any brands from my home." E-commerce platforms like Amazon, Flipkart, and Nykaa have made it easy to access brands that were once limited to metro cities. This ease of access means consumers in smaller cities can now buy from global skincare brands easily.

How does it influence skincare? Wider product range: Consumers have access to a diverse range of skincare products, from local to international brands.

Experimentation: The ease of purchasing encourages consumers to try new products and develop more comprehensive skincare routines.

#3 And other important factor is Social Media and Influencers: "I trust what my favorite influencer recommends."

Social media and influencers have played a massive role in educating the masses about skincare and how to do make up. From Instagram tutorials to YouTube reviews, people now know their skin type, concerns, and the products they need.

How does it influence skincare and makeup products? Trend-driven choices and Trust in local brands: Consumers often make purchases based on viral products or influencer recommendations. Consumers are more likely to trust and choose Indian brands that understand local skin concerns.

Diverse product offerings is a one of the factor These brands offer a wide range of products tailored to Indian skin types and climate conditions.

Community based learning: Social media platforms allow users to share experiences and learn from each other's skincare journeys. through on youtube video comment section and social media.

#4 Celebrity Brands and Influence: "If it's good enough for my favorite star, it's good enough for me." Celebrity-owned beauty brands are making significant inroads into tier 2 and some part of tier 3 cities in India by leveraging their star power and relatability. They employ relatable marketing strategies, sharing personal skincare stories that resonate with fans. These brands create content in regional languages, offer affordable pricing options, and engage directly with consumers through social media. They address local skin concerns, positioning their products as aspirational yet attainable. Celebrities tap into existing fan clubs and communities, collaborate with local micro influencers, and maintain a presence in traditional media. Some brands even organize pop up events or temporary stores in smaller cities. By using personal stories, local languages, affordable pricing, social media engagement, and addressing specific skin issues, these brands create a sense of connection with consumers. They position themselves as aspirational yet accessible, leveraging fan bases and local influencers to spread awareness. Through a mix of digital and traditional marketing, along with physical events, celebrity beauty brands are successfully tapping into the aspirational mindset of tier 2 and 3 consumers, making them feel closer to their favorite stars through skincare choices. This approach not only boosts sales but also contributes to the overall growth of the skincare market in these regions.